accumulated earnings tax reasonable business needs

Q2 2022 ORLADEYO net revenue of 652 million FY 2022 ORLADEYO net revenue expected to be between 255 million and 265 million RESEARCH TRIANGLE PARK NC Aug. Section 43 of the Corporation Code of the Philippines in effect prohibits a stock corporation to maintain a retained earnings more than 100 of.

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Consideration should be given to the relationship between IRC 531 Imposition of accumulated earnings tax IRC 541.

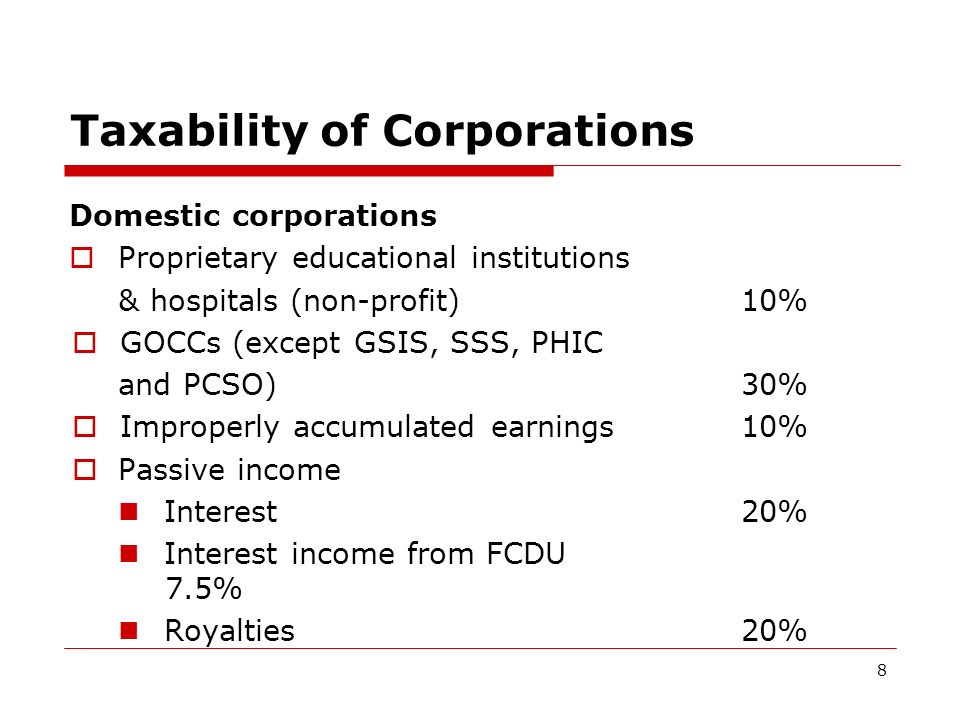

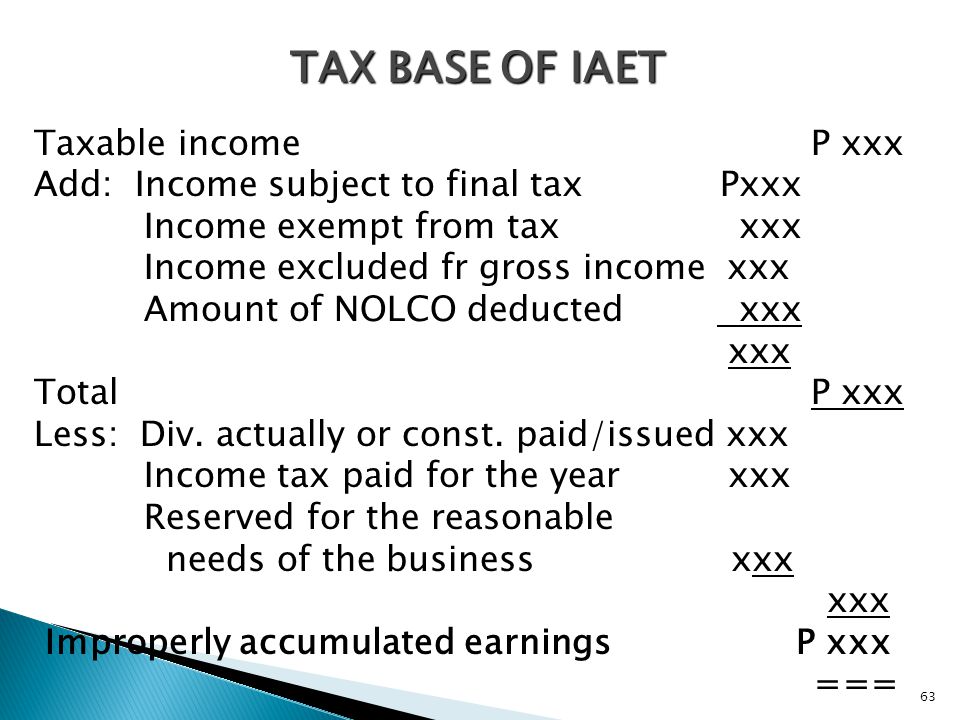

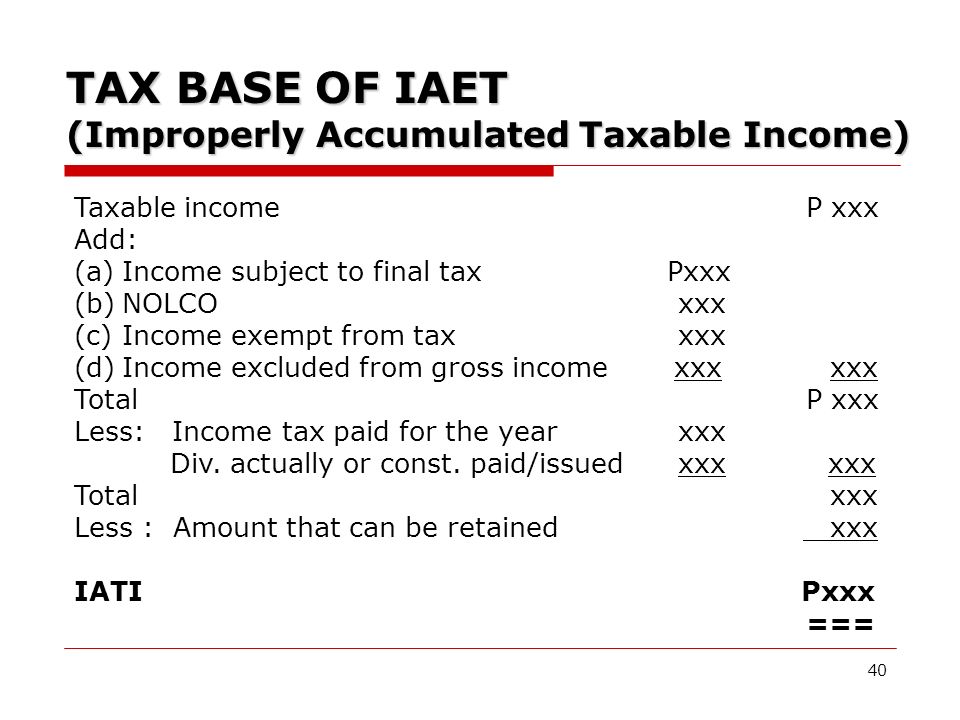

. In simple and plain language improperly accumulated earnings tax is a penalty tax upon a corporate taxpayer for accumulating so much net income after tax beyond the reasonable needs of the business. However if the company presented a statement of retained earnings for 20X5 the opening balance would be adjusted by 280 400 30On a pretax basis 20X5 income would increase by 3600 and after-tax income would increase 2520 3600 30 x 400 for the impact of the change in years before 20X5. We would like to show you a description here but the site wont allow us.

These are the accumulated earnings tax AET under Secs. It applies to all corporations unless an exception applies that are formed or availed of for the purpose of avoiding the income. The AET is a 20 annual tax imposed on the accumulated taxable income of corporations.

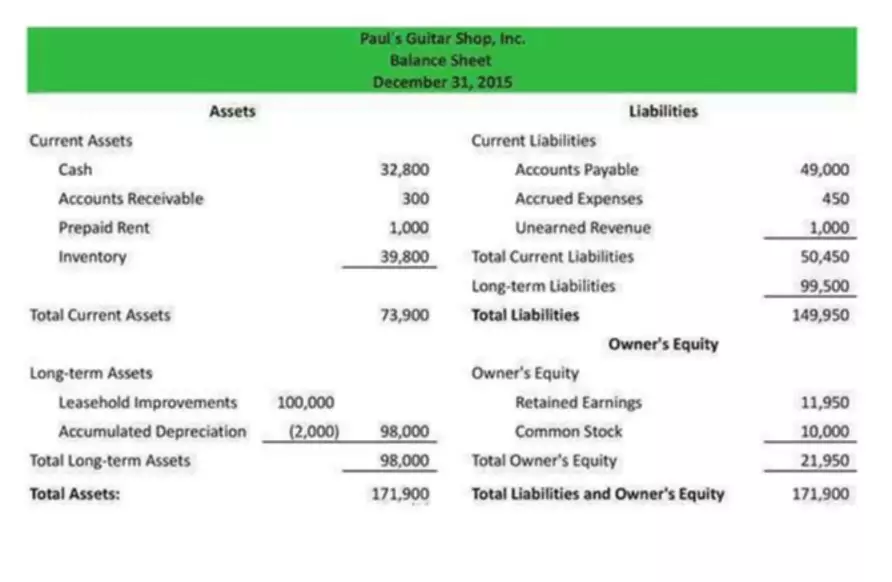

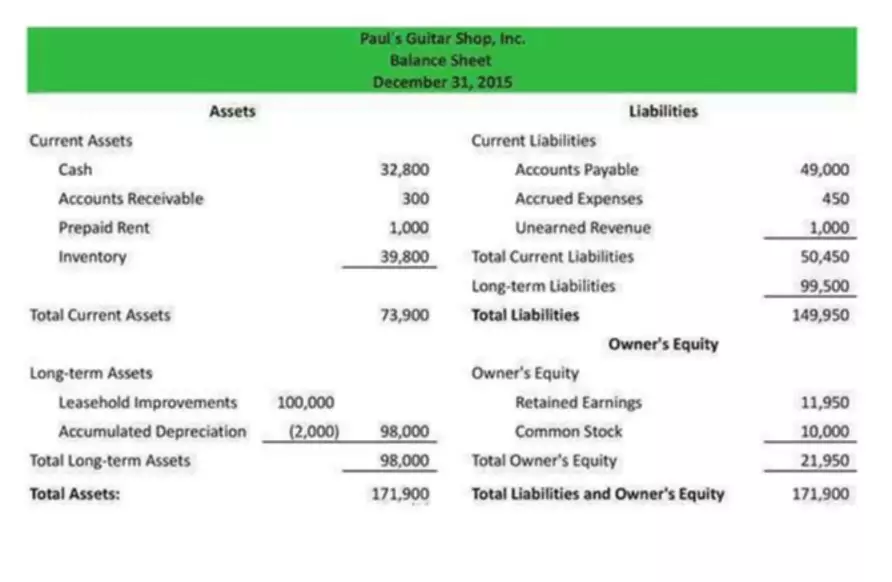

However if a corporation allows earnings to accumulate beyond the reasonable needs of the business it may be subject to an accumulated earnings tax of 20. Retained earnings are an integral part of equity. The issue will be dropped if it is concluded that earnings and profits have not been accumulated beyond reasonable business needs.

531-537 and the personal holding company PHC tax under Secs. 04 2022 GLOBE NEWSWIRE -- BioCryst Pharmaceuticals Inc. Accumulated earnings of the organization for the reporting year is the final financial result of its activities fewer dividends paid.

Retained earnings are a total of all the accumulated profits that a company has received and has not distributed or spent otherwise. If the accumulated earnings tax applies interest applies. NasdaqBCRX today reported financial results for the second quarter ended June 30 2022 and provided a.

A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons.

:max_bytes(150000):strip_icc()/GettyImages-1089395350-f33f180d2b234b268f6df527045f8de0.jpg)

Accumulated Earnings Tax Definition

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

/GettyImages-185121887-3537e49a2e394fe5927d3cfb1dd0a8fb.jpg)

Accumulated Earnings And Profits Definition

Doing Business In The United States Federal Tax Issues Pwc

Current Developments In S Corporations

:max_bytes(150000):strip_icc()/a_10-5bfc387746e0fb0051486be9.jpg)

Accumulated Earnings Tax Definition

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Retained Earnings Normal Balance Bookstime

Strategies For Avoiding The Accumulated Earnings Tax Krd Ltd

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

/GettyImages-1130199515-b011f8c58a144789b22c7107929ffb8f.jpg)

Accumulated Earnings Tax Definition

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Overview Of Improperly Accumulated Earnings Tax In The Philippines Tax And Accounting Center Inc

The Income Tax Rate Of Corporations Lowered In The Philippines Lawyers In The Philippines